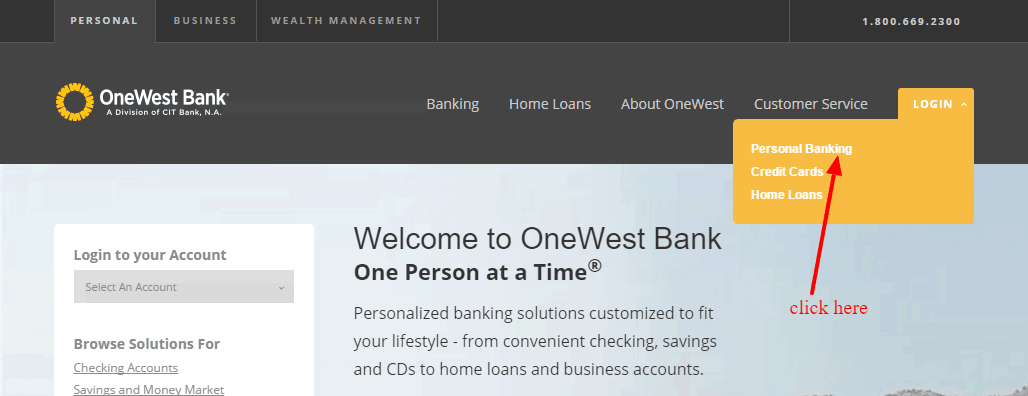

Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward. This change is now active for both web login through this page as well as logins though the mobile app. We believe that this new process will help us better protect your account information by adding another level of protection against unauthorized access.

Please,nevershare your online banking login credentials with anyone, and please do not share any SMS verification codes with a third party. These credentials and codes are only for you, and are meant to protect your account. Sharing them, for any reason, defeats the protection that they provide.

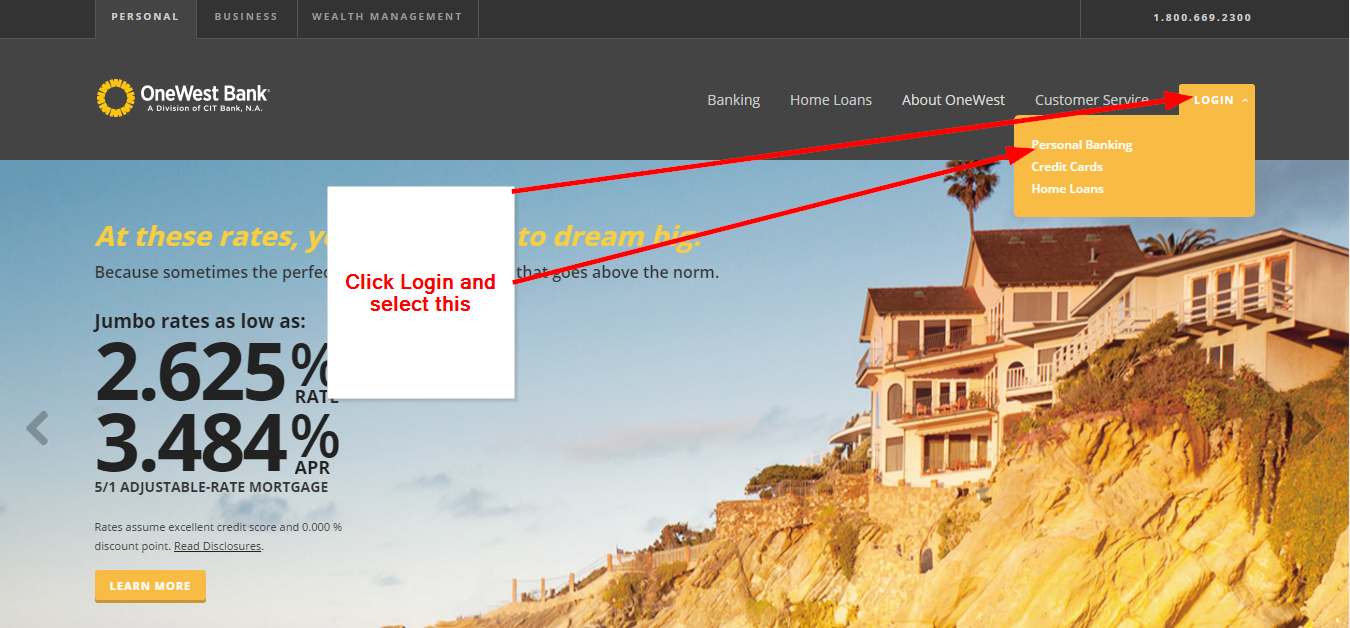

The COVID-19 pandemic has led to an increase in online shopping and digital banking, offering more opportunities for bad actors to victimize consumers. A common method is the use of digital messages that appear to be from your bank instructing you to call a phone number to resolve an account issue. Great Western ebanking can be accessed online 24 hours a day from almost any Internet browser. When you bank online, you can transfer funds, view statements and check balances on all of your accounts including checking, savings, loans, and certificates of deposit.

Do all of this, plus more, on your time from a single location. The redemptions will post within 2 to 8 business days. 4Touch ID is available only for newer iPhone models using iOS 8 or higher.

Face ID is available only iPhone models X and later. Use of your Mobile device requires enrollment in Online Banking and download of our Mobile App. Wireless carriers may charge fees for text transmissions or data usage. Mobile Banking requires an internet-ready phone and is supported on Apple iPhone devices with iOS 9 and greater and on Android mobile devices with OS 5 and greater.

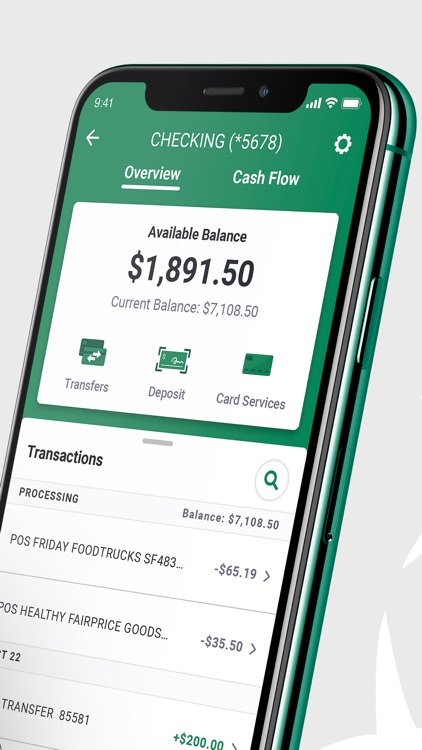

Mobile deposits made before 7 pm PT will be processed the same business day and made available within two business days. Longer delays may apply based on the type of items deposited, amount of the deposit, account history or if you have recently opened your account with us. Checking & savings accounts, online & mobile banking, debit cards, and more. Our products and services are designed to fit your lifestyle. Some exclusions apply to certain categories of transactions.

No statement credit will be applied, in whole or in part, against any monthly minimum payment due. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits. If you or your business have been financially impacted, we're here to assist you. Visit our COVID-19 information page to learn more about online banking services, financial assistance programs and fraud protection.

First Citizens does not charge fees to download or access First Citizens Digital Banking, including the First Citizens mobile banking app or First Citizens Text Banking. Mobile carrier fees may apply for data and text message usage. Fees may apply for use of certain services in First Citizens Digital Banking.

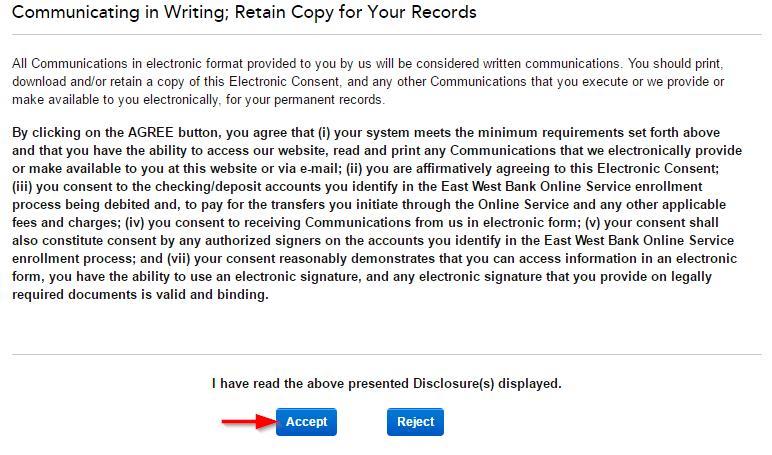

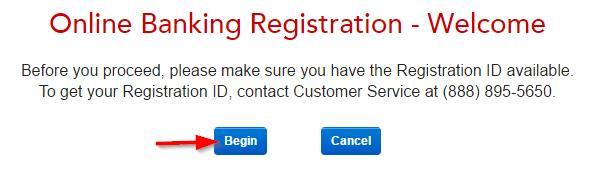

You online banking sessions have now become more secure! In order to increase security and provide robust account protection, we have now implemented a multifactor authentication process to your online banking login. Beginning October 1, the USPS will be slowing mail delivery for many Americans across the country. Stay up to date with your accounts via online and mobile banking. You can check your account balance, view transaction history, make transfers and sign up for eStatements. Make a note on the check that it was deposited using Mobile Deposit.

Keep the check for 45 days, then dispose of it securely by shredding the check. If there are problems processing your mobile deposit, you may need your original physical check to resolve the issue. An image of the deposited check remains available on your phone for 30 days. You can view your Mobile Deposit history by selecting "Deposit History" within the mobile app. Did you know you can send a secure email for many account inquiries?

After you login, simply select "Additional Services" to send a secure email. Submit an address change, add travel notes, request debit card limit increases or simply ask general questions regarding your account. Woodforest is a community bank built upon the needs of the customers we serve. Our night drop is an easy way to utilize contactless delivery, and it can be used for deposits and loan payments.

Include a deposit slip and your payment information in an envelope and place it the night drop slot, and an associate will take care of it the next business day. It is a simple, safe and secure way to make a deposit or payment. Learn about Northwest's innovative digital banking solutions. Did you know that you can view your account statements online?

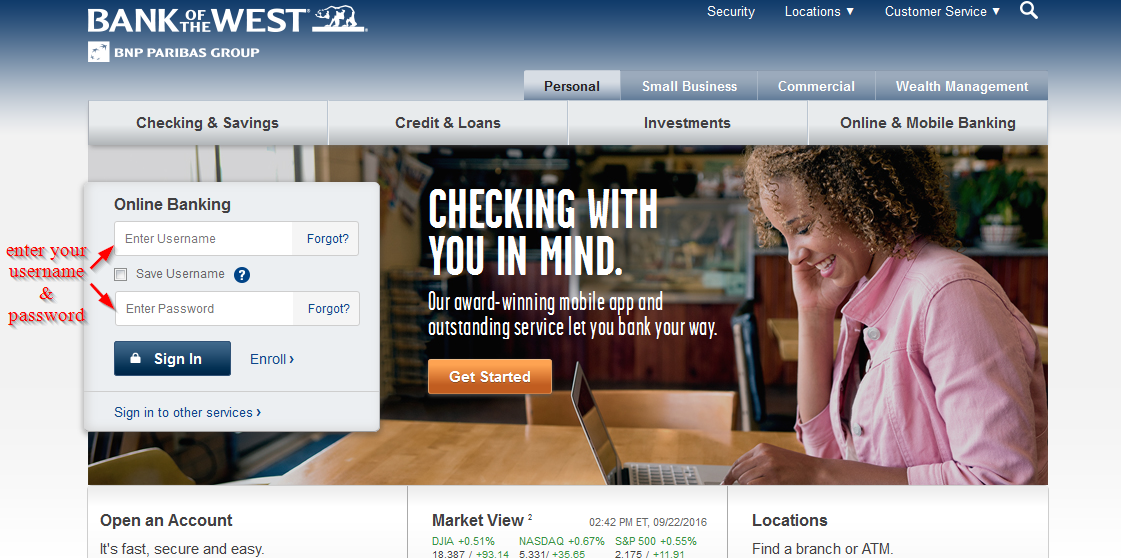

You can view up to the past 18 months of account statements from within online banking by clicking the "Documents" tab while viewing any account. If you would like to "go paperless" and receive your statements only by electronic means, you can do that too! If you'd like more information regarding eStatements, please contact your local branch office of The Bank of The West. Our mobile devices are convenient and are a big part of how we keep in touch with the world.

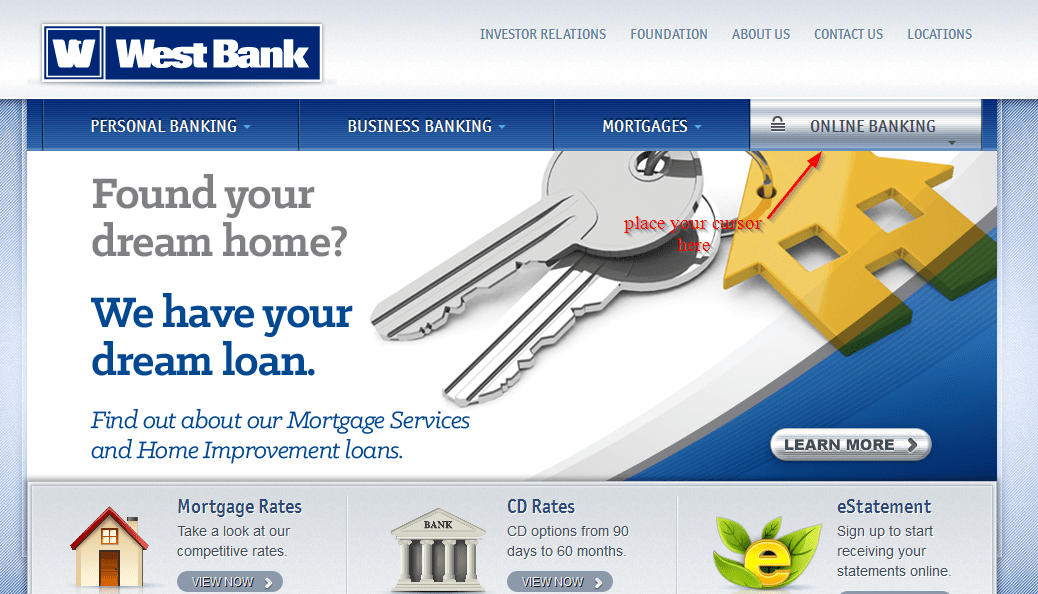

It makes sense that we now have banking information at our finger tips, 24/7. Bill Pay is now available for consumer online banking users through our website or our convenient mobile app. If you are interested in signing up for Bill Pay, please contact your local Branch office for more information. You can transmit mobile deposits to West Bank 24-hours a day, 7-days a week including weekends and holidays, with the exception of our routine maintenance downtimes.

Deposits can be made any time in the Mobile App, and checks are generally credited to your account within two business days. At United Bank, we're dedicated to providing exceptional customer service. Whether it's a lost check card or questions about refinancing your home, feel free to reach out to us at any time, via phone, e-mail, or 24/7 online. We'll do all we can to help and won't rest until your questions are answered, or your problems are resolved. Use online banking or our app to set up customized alerts for the transactions you care about most.

Card alerts are easy to set up and help protect you from fraud. No time to get to the bank or an ATM to make a deposit? With Availa Bank's mobile banking you can make safe and secure deposits using your smartphone. Our digital banking services offer you a simple, secure way to bank from anywhere, anytime. By now, mobile banking is a pretty common term that most of us hear on a day to day basis. In today's world nothing can be 100% secure from some type of compromise, but the banking industry has taken major steps to make sure that mobile banking apps are secure.

The problem often lies with the mobile device and how it connects to internet. 1$10.00 monthly service charge for Any Deposit Checking and 1% for the Planet Checking waived with one deposit of any amount each statement cycle. Deposits include direct deposit, mobile deposit, ATM deposit, or in-branch deposit of any amount.

Does not include fund transfers between Bank of the West accounts or any credits from Bank of the West. No monthly service charge if any account owner is under 25 years of age. Monitor and manage your debit cards right in the myBTRmoney app. Protect yourself and receive mobile alerts, customize your usage by setting limits and get peace of mind by turning "off" your cards if they are lost or stolen.

How to enroll in digital identity protection Learn how to enroll and create your AlwaysChecking profile from our mobile banking app. How to send a friend money with Person-2-Person payment Learn how to send money to another person directly using our mobile app. How to sign into Mobile Banking Learn how to sign into our mobile banking app and add an extra layer of security.

With Cash Back Rewards, you will earn 1 reward dollar for each $100 net dollars you spend for net retail purchases . Earned reward dollars are calculated on actual dollars spent rounded up or down to the nearest point. Reward dollars will be deducted from the available rewards account balance for all returned purchases. After you have logged in, select Profile and Preferences from the left navigation menu and then select Login Preferences. From this page you can reset your login ID, password and secure delivery method (the way you'll receive your one-time secure access code).

If you are in the Digital Banking app, you can also manage fingerprint and 4-digit PIN access. If you can't log in, you'll have to call the Customer Care Center to have your secure login reset. Don't save your password, account number, PIN, answers to secret questions or other such information in an unprotected manner on the mobile device.

Consider using a secure password keeper app for this purpose. Whether you're using the mobile Web or a mobile app, don't let your device automatically log you in or remain connected to financial or sensitive apps or websites. Otherwise, if your phone is lost or stolen, someone will have easier access to your information.

For more information on mobile capture, please visit our Tips and Advicepage. If you would like to sign up for mobile deposit capture, please contact your local branch. If you are the primary business account holder AND have accessed online banking before the upgrade, use your current username to log in. All previous online banking members will need to set up a new password.

If you used online banking before the upgrade, use your current username. You may use your prior password if you remember it or choose a new one. Now offering convenient online personal checking and savings account opening.

To show our appreciation and respect for the sacrifices you make, Peoples Bank has created a banking program for our hometown heroes. Add the Hometown Heroes program to any Personal, Interest Plus or Premier checking account. Fall is the perfect time to open a student checking account and help your student gain financial experience. We provide foreign exchange solutions to businesses for international payments, risk management, and cash management.

Our FX specialists can consult with you to understand your business, identify your foreign exchange exposures, and customize solutions to minimize your risk in foreign markets. Never share your online banking username or password with anyone who is not authorized to have access to your account. You are now leaving our site and being linked to a third party website. Any products and services accessed through this link are not provided, endorsed or guaranteed by Great Western Bank.

Great Western Bank will not be liable for any loss or damage resulting from your use of any aspect of this site and all such use is solely at your risk. The reason you may be experiencing this issue is your browser is not set to store cookies from our online banking website. Once you enter the security code, a cookie placed on your computer to allow the system to remember you. You must allow cookies with your settings on your computer to avoid this information from being deleted each time you close your browser. With a Gate City Bank checking account, sit back, relax and receive your paycheck or other direct deposits up to two days early. The SouthState Mobile App lets you securely pay bills, send money, and manage your accounts anytime, anywhere.

No, mobile deposits cannot be seen in Online Banking until the transaction has posted to your account. In the interim, you can view the status of the deposit in the Deposit History link in the Mobile Banking app. In the West Bank Mobile app, on the "Deposits" tab, click the Deposit History link to check the status of your mobile deposits. A "Pending" status indicates that the funds have not yet been deposited to your account. A "Failed" status indicates that your deposit has rejected.

An "Approved" status means that the funds have been deposited to your account. Access your account on your smartphone with the mobile banking app. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Some financial institutions may prevent you from connecting your accounts to third-party apps through Plaid.

Our goal is to work with these financial institutions to enable access to your financial data so you can use the tools you rely on to manage your money. From offering you a variety of deposit products to servicing your loans, we're dedicated to providing you with the resources to make your banking experience as convenient as possible. If you'd like to learn more about our dedication to serving your banking needs, please schedule an appointment at one of our banking centers. You can easily enroll in Digital Banking on our homepage by selecting the Enroll Now link located in the login box. You'll need an active First Citizens account to get started. If you don't have an account, you can open one online, visit your local branch or give us a call.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.